International Freight for Heavy Industry

Panama Canal Congestion

Panama Canal Congestion

On July 30th, the Panama Canal Authority implemented restrictions to combat what they describe as an “unprecedented” drought.

While canal delays due to low water levels are not new, the canal faced the lowest rainfall this century and the Gaten Lake, which feeds the canal, has water levels at a four-year low.

The dual system on the canal locks runs on fresh water, with only the Noepanamax locks able to reuse some of the water used to transit the vessels. A canal lock uses 50 million gallons of water when a single vessel traverses the canal.

On announcing the new restrictions in July, the canal’s authority said, “The canal has experienced an extended dry season with high levels of evaporation, with a high probability of an El Nino condition before the end of this calendar year.”

These restrictions limit the total daily transits to 32 (a drop from the 34-36/day average). The Panamax lock is capped at 22 per day, only 14 of these slots can be pre-booked. The Neopanamax lock is capped a 10 transits per day, which is about the usual amount. However, the maximum draft for a vehicle transiting the Neopanamax lock has been reduced from 15.32 metres to 13.41 metres, forcing vessels to lighten their loads.

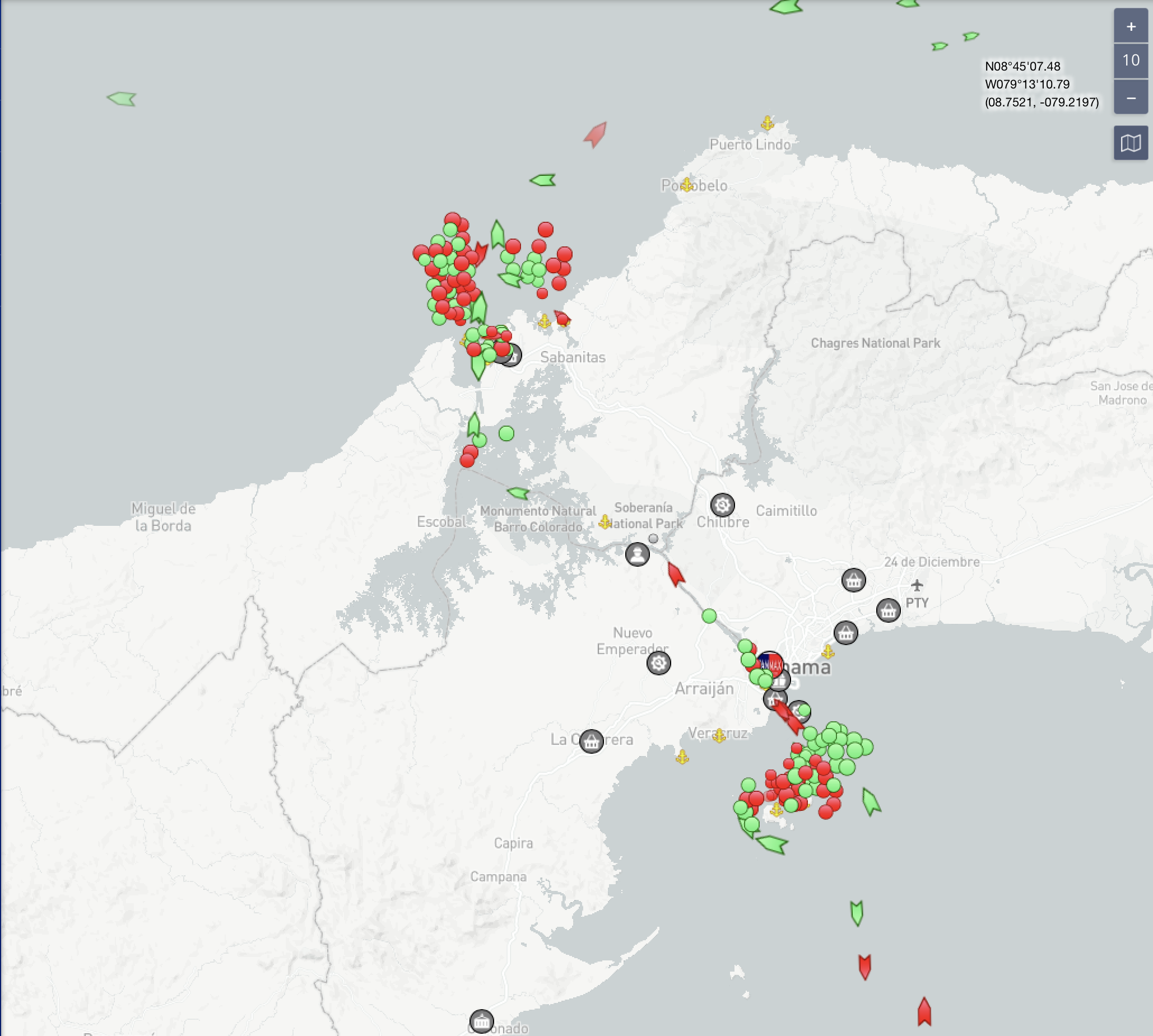

The canal authority claims there are no delays for vehicles with a reservation, vehicles without are currently facing a 9-10 day delay (up from the usual 5-day wait). The number of vessels queuing to pass through the canal peaked in August at 165 vessels. As of Tuesday (Sept. 5), the ACP noted the total number of vessels queuing has dropped to 108 – this is still 20% higher than the goal set out by the ACP of keeping queues under 90.

These draft and transit restrictions are here until mid-way through 2024.

Jon Davis, Everstream Analytics’ chief meteorologist said, “The short-term forecast into early September looks problematic. A continuation of below-normal rainfall across Panama and well-above-normal temperatures will not improve the situation. Normally at this time of year, lake levels are increasing since it is the core of the wet season.”

Davis said El Nino events are strongly associated with below-normal rainfall, especially during the winter months — December through February — which is the start of the dry season for the Panama Canal region.

“Hence, the issues that have developed in the Panama Canal look to continue for an extended period,” Davis said.

Adil Ashiq, head of North America for MarineTraffic warned that if the dry season continues and water levels of the canal do not improve, the restrictions could further tighten, leading to even more delays and higher shipping costs, which would have a ripple effect on the global supply chains.

“This is most prevalent for bulk markets, such as raw materials and commodities like oil and gas,” Ashiq said. “Delays could lead to higher gas prices in the coming months or, worst case, shortages in certain markets. Shippers moving goods should prepare for higher shipping costs, longer transit times and delays. If a vessel is unable to make a transit through the canal, then a trip around South America will add up to two weeks of journey and higher fuel consumption — a cost which will be passed down to consumers.”

Tramp trades are facing the worst delays, without the security of fixed schedules allowing shippers to book their transit through the canal in advance. Tramp Trades are most likely to take the multi-week detours via the Suez Canal and Cape of Good Hope.

While container ships aren’t being delayed in wait times “It has an effect because it means you can load less on the ships,” said Rolf Habben Jansen, CEO of ocean carrier Hapag-Lloyd, on the company’s latest quarterly call. “The effect is not immaterial, but it’s also not huge.”

Meanwhile, the effects on LPG carriers are being felt more severely. LPG carriers “are starting to see large delays, whereby ships are deviating around the Cape [of Good Hope] if they go to Asia,” said Oeyvind Lindeman, CEO of LPG carrier owner Navigator Gas (NYSE: NVGS), during a conference call on Aug. 16.

Dry bulk is also being affected by queues and wait times – which is affecting spot rates.

The Panama Canal Authority has provided these resources for current information on Panama Canal transits, lake levels and conditions:

To stay up-to-date with the latest updates and other industry news head to the Freightplus Newsroom or get in contact with the Freightplus team.