International Freight for Heavy Industry

Port of Singapore Faces Significant Congestion Amid Global Supply Chain Crisis

Port of Singapore Faces Significant Congestion Amid Global Supply Chain Crisis

June 12, 2024

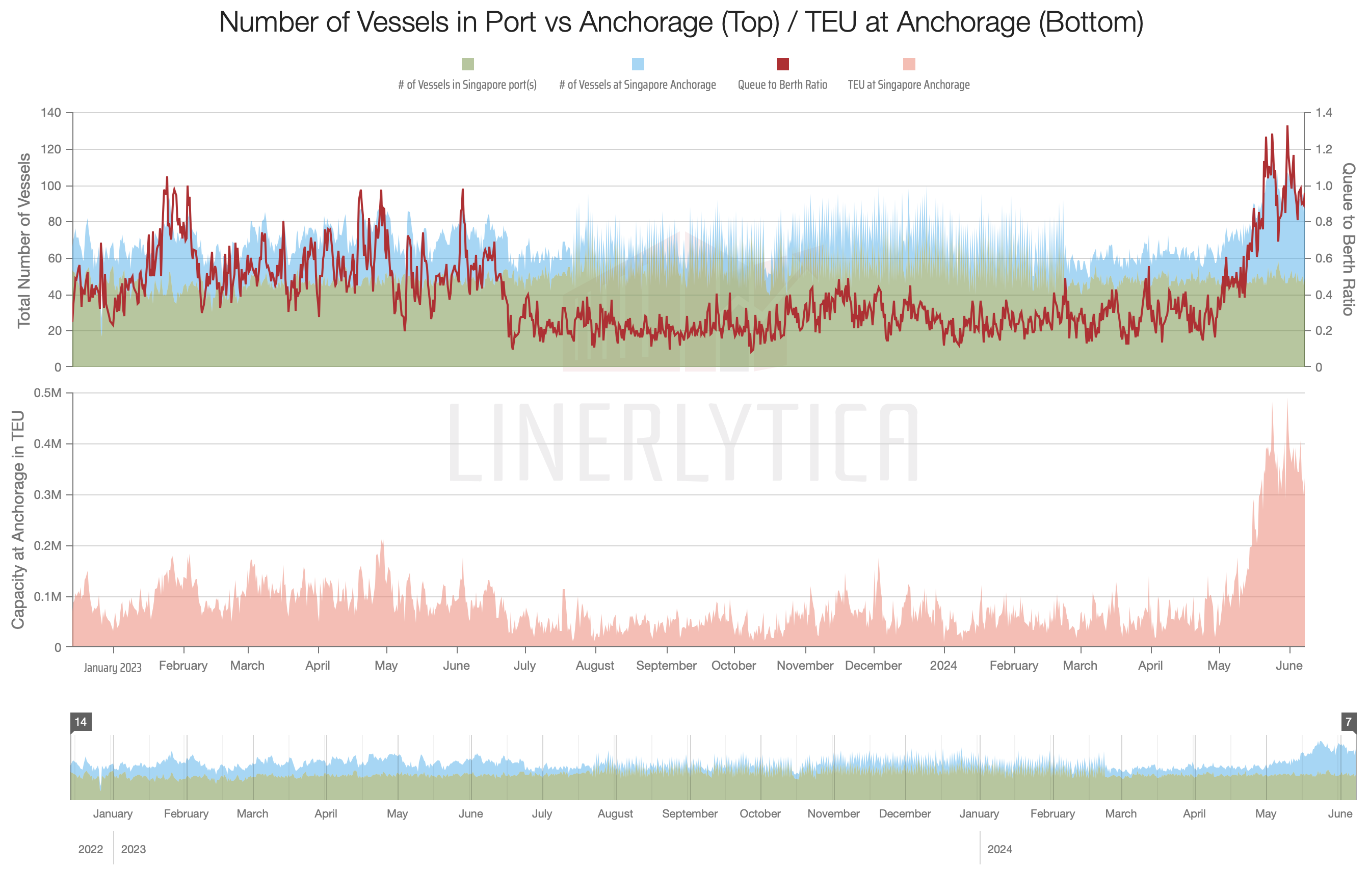

The Port of Singapore, the world’s second busiest container port, is currently experiencing severe congestion, causing a significant impact on global supply chains. According to market intelligence firm Linerlytica, the port has reached a critical bottleneck, handling a staggering 2 million twenty-foot equivalent units (TEUs), which accounts for nearly 7% of the global fleet’s capacity.

Southeast Asia, a vital hub in global trade, now represents 26% of worldwide port congestion. Singapore, as the largest transhipment hub, is particularly hard-hit, facing extensive backlogs exacerbated by a shortage of containerships and equipment. This has increased freight and shipping costs, posing an imminent supply chain crisis.

“The early arrival of the ocean peak season, combined with diversions through the Red Sea, has strained capacity and schedules, leading to worsening congestion, equipment shortages, and elevated prices,” said Judah Levine, head of research at Freightos. Levine also noted that with capacity scarcity, spot rates have surged to levels several thousand dollars above long-term contract rates, making annual agreements increasingly unreliable.

The Shanghai Containerised Freight Index (SCFI) has risen to its highest level since August 2022, jumping another 140 points to 3184.87 as of June 7. Similarly, the Drewry World Container Index, published on June 6, recorded a 12% increase, reaching $4716 per forty-foot equivalent unit (FEU), marking an 181% rise compared to the same period last year.

Linerlytica warns that the situation is likely to worsen in the coming months. Vessels are now diverting around South Africa on Asia-to-Europe runs due to security concerns in the Red Sea and Indian Ocean, adding extra transit times. This has led to an estimated 450,000 TEUs in queue at the Port of Singapore, with vessels waiting up to seven days for a berth, a significant increase from the typical half-day wait.

The Maritime and Port Authority of Singapore (MPA) attributes the vessel-bunching effect to off-schedule arrivals. In response, the MPA, along with Singapore’s transportation ministry and PSA, the port’s operator, has been working since late 2023 to add more manpower and container handling capacity. This includes reactivating previously decommissioned berths and yards at Keppel Terminal, and increasing the port’s weekly container handling capacity from 770,000 TEUs to 820,000 TEUs.

Shipping companies also adapt to the congestion by deploying every available vessel and skipping less busy ports, such as Port Klang in Malaysia. However, this rerouting is causing containers to pile up or be rerouted to Singapore, further straining the port’s capacity.

Maersk, one of the world’s largest container shipping companies, reported “substantial” delays in its schedules due to the severe terminal congestion. The company and MSC plan to introduce blank voyages in the coming weeks to manage the backlog.

Sea-Intelligence has observed that the minimum transit time from Asia to the Mediterranean in Q1 2024 increased by 39% compared to the average in the second half of 2023.

As the global shipping industry navigates these challenges, the Port of Singapore remains a critical epicentre, with efforts to alleviate congestion ongoing. The coming months will be pivotal in determining the resilience and adaptability of global supply chains in the face of these disruptions.

To stay up-to-date with the latest updates and other industry news head to the Freightplus Newsroom or contact the Freightplus team.