International Freight for Heavy Industry

The effects of the Panama Canal situation will be felt well into 2024

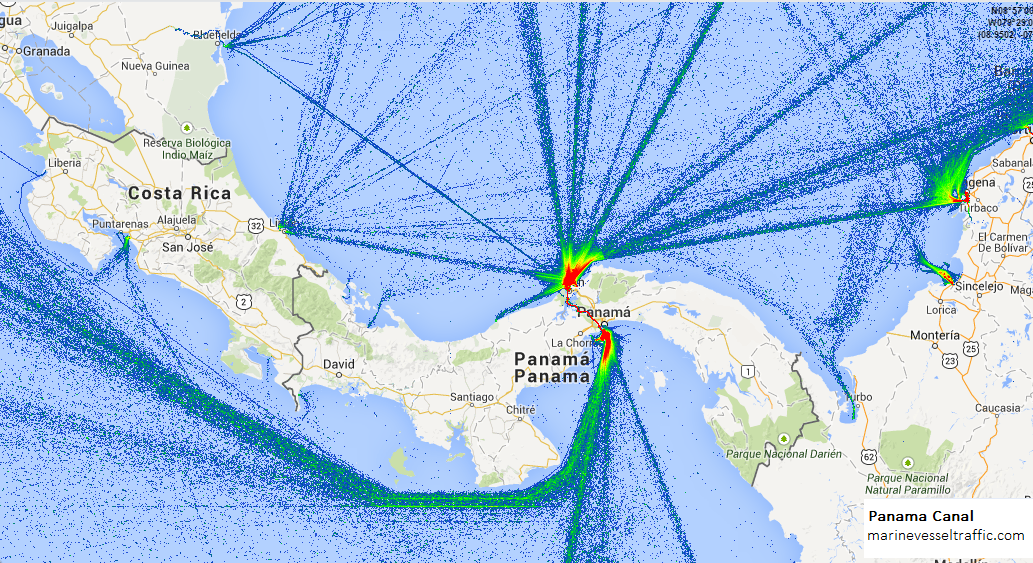

The Panama Canal is grappling with a series of challenges that are set to impact the shipping industry in the coming months. From the driest October in 73 years to the onset of the el-nino weather phenomenon, the shipping industry is set to be feeling the consequences of the biggest drought the region has seen in nearly two decades well into next year.

As of December 1, the Panama Canal Authority has capped daily transits at 22, on January 1 this will drop again to 20/day, and again will drop to 18 come February 1, 2024.

The ACP has opened up a special auction slot, dependent on the levels and projected levels of the Gatun Lake. These slots are open to Neopanamax full container vessels that have already entered the Canal waters without a booking slot. Three days before transit set conditions are released, and two days prior the auction will occur, with the initial bid set for $93,500.00. The ACP has stated that these special auction slots are not representative of transit advancement.

As of today (December 7, 2023), ACP data shows that 83 vessels are currently queued for transit, two of those vessels have reached a wait time of 32 days.

Dry Bulk and LNG sectors are bearing the brunt of the reduced transit restrictions as they don’t have the luxury of adhering to fixed schedules as liner shipping does and rather arrive at the canal on an ad hoc basis.

Christian Roeloffs, co-founder and CEO of Container xChange said, “Liner shipping has faced minimal consequences from transit reductions but has primarily been affected by draught reductions. The maximum draught has been decreased from 50 feet to 44 feet, with each foot reduction in draught resulting in a “loss” of 400 TEU capacity. Consequently, an average container vessel can now transport 2400 TEU less.

“At present, container shipping trade flows remain unencumbered. However, anticipating increased pressure on the US East Coast, the Suez Canal and the Cape Horn in the coming months, shippers are likely to explore alternative routes to circumvent potential disruptions.”

The reduced transit times have halved the number of vessels transiting, caused shipping companies to reroute vessels, increased blank sailings, longer transit times, prolonged wait times and potentially higher shipping costs in coming times.

The heightened competition for available spots has driven up spot freight rates, prompting carriers to re-evaluate pricing to offset increased costs and uncertainty. Several carriers have already announced new fees for Panama transits.

Furthermore, carriers are redirecting more volume to the US West Coast or opting for routes via the Suez Canal. This results in a shift in shipping patterns which rolls on to impact transportation costs, delivery times and overall supply chain efficiency.

Project Cargo Journal expect the mid to long-term repercussions will easily run throughout the next year due to irreversible environmental concerns that will dwindle the performance of the canal over time.

To stay up-to-date with the latest updates and other industry news head to the Freightplus Newsroom or get in contact with the Freightplus team.